Create designs

that inspire

that inspire

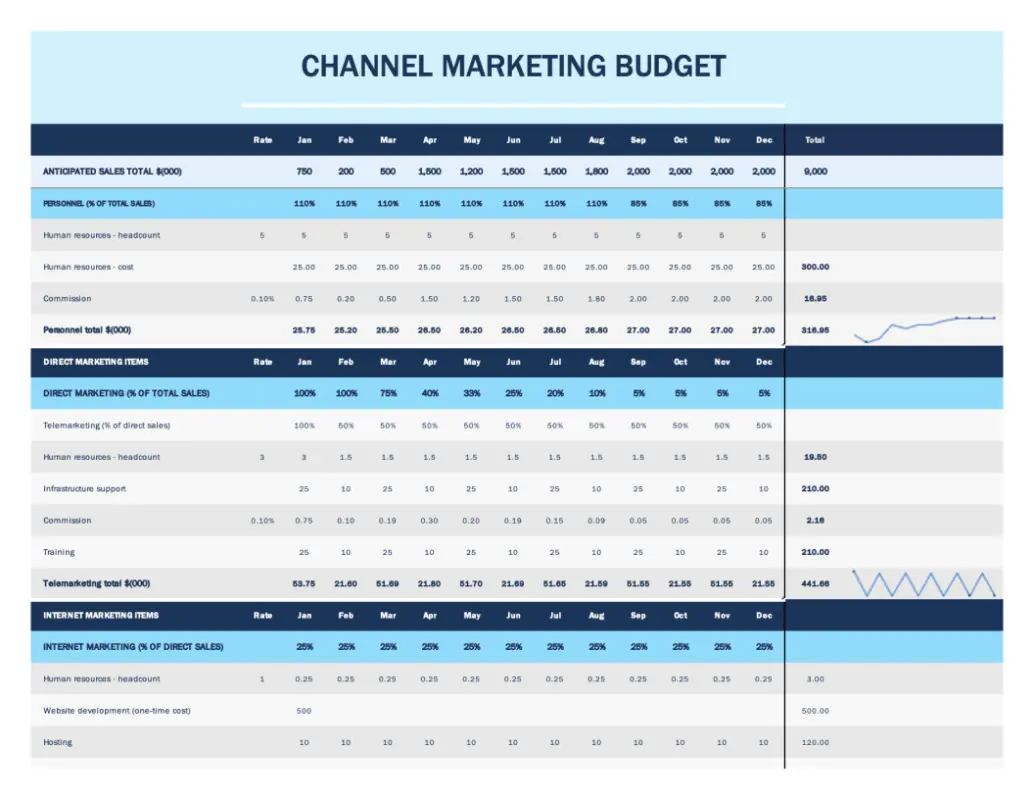

Productivity

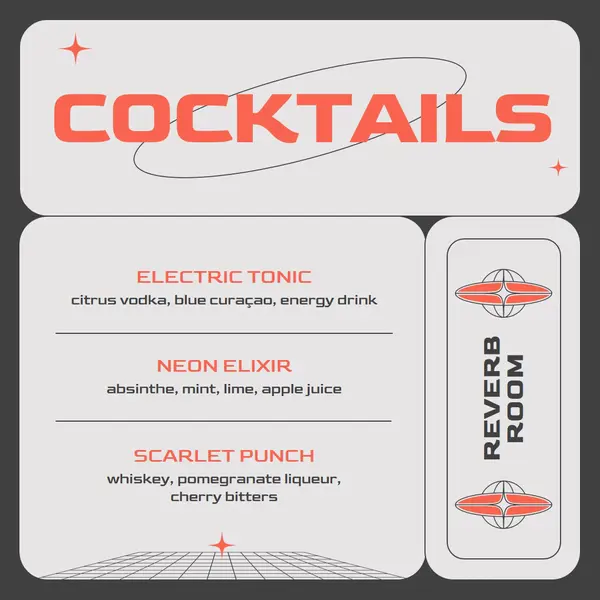

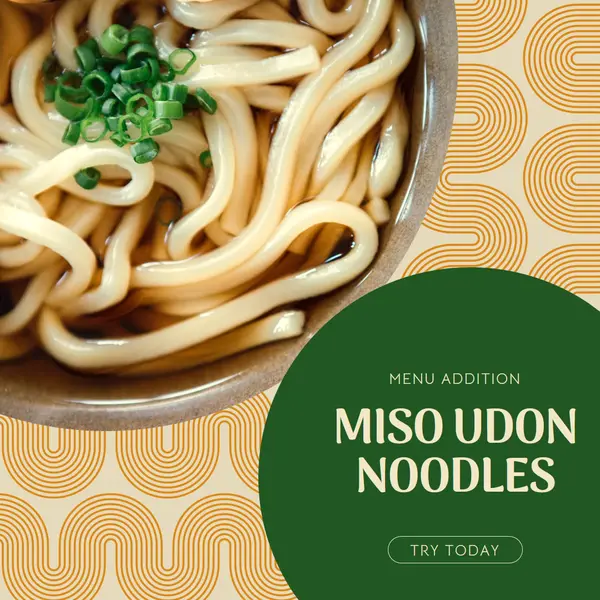

Social media

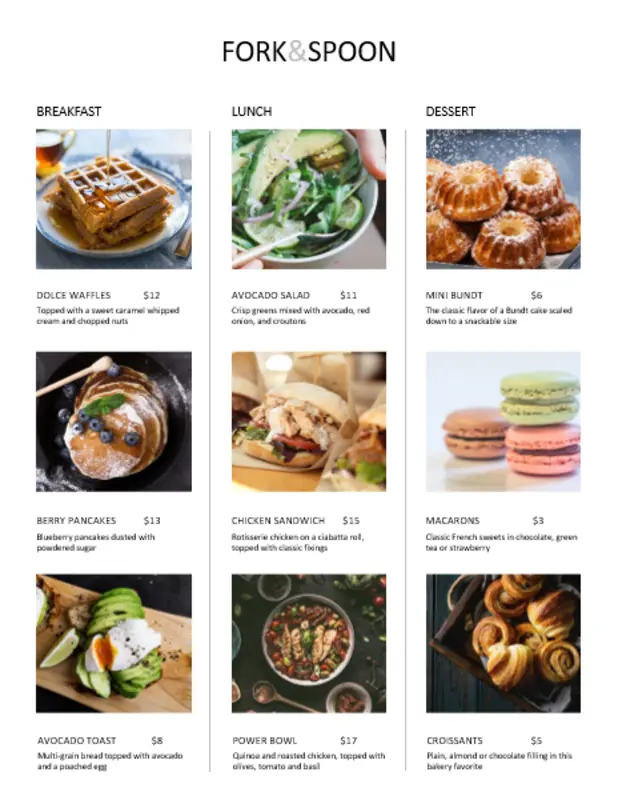

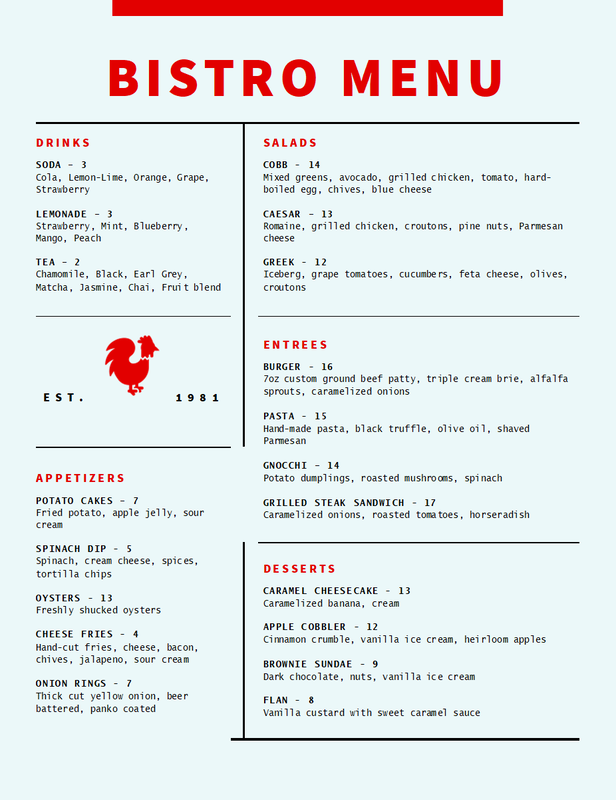

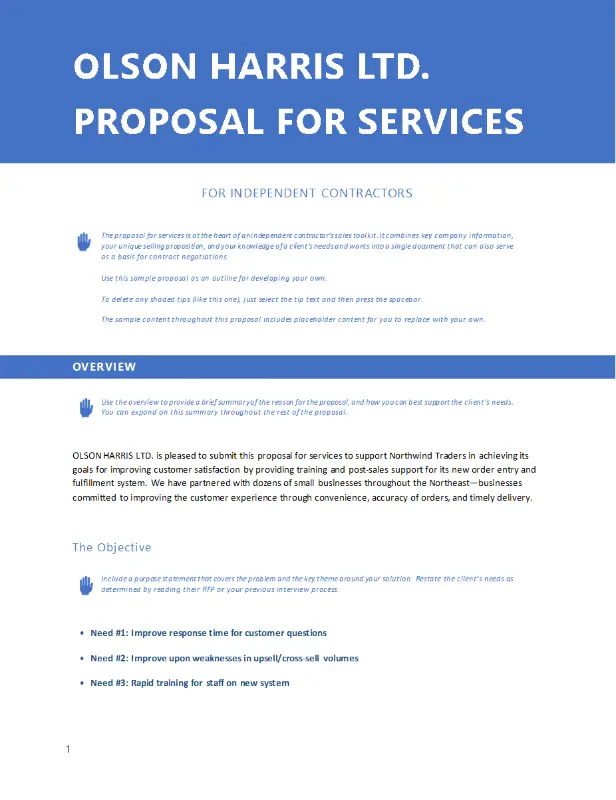

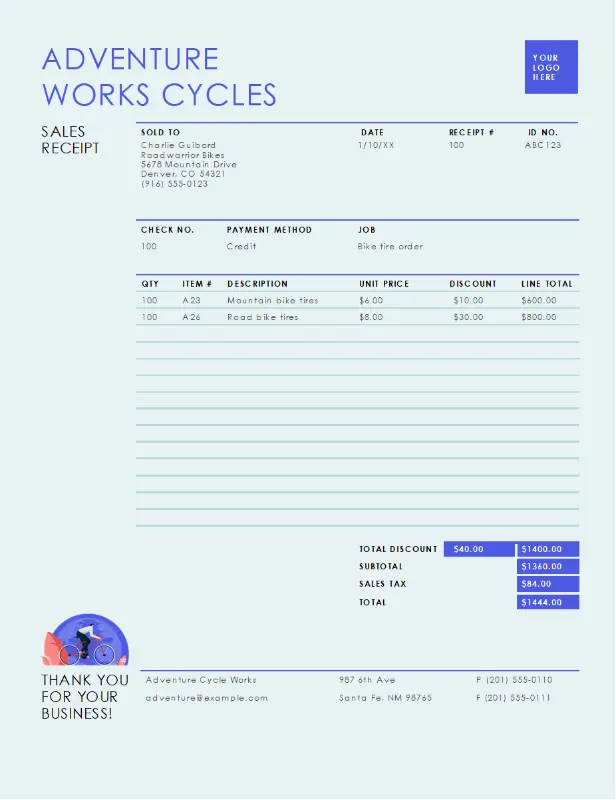

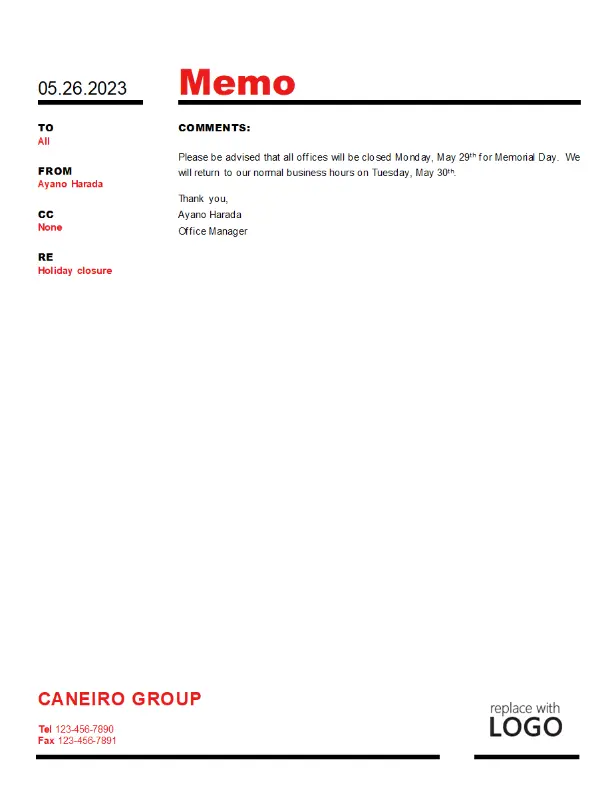

Print

Create and edit in an instant with Microsoft Designer

How it works

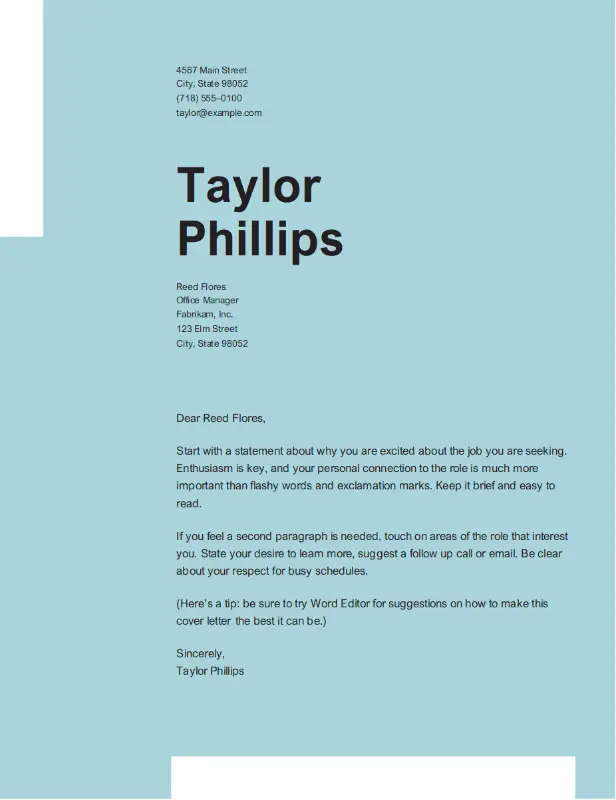

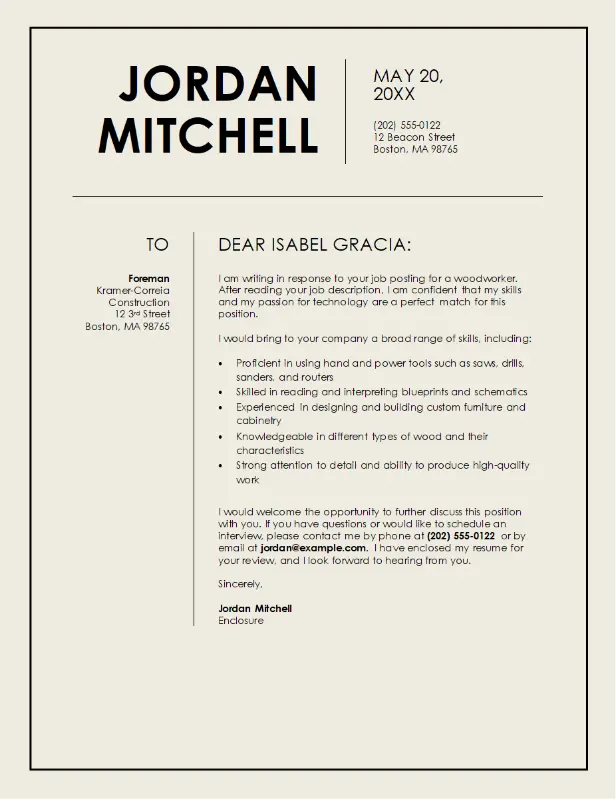

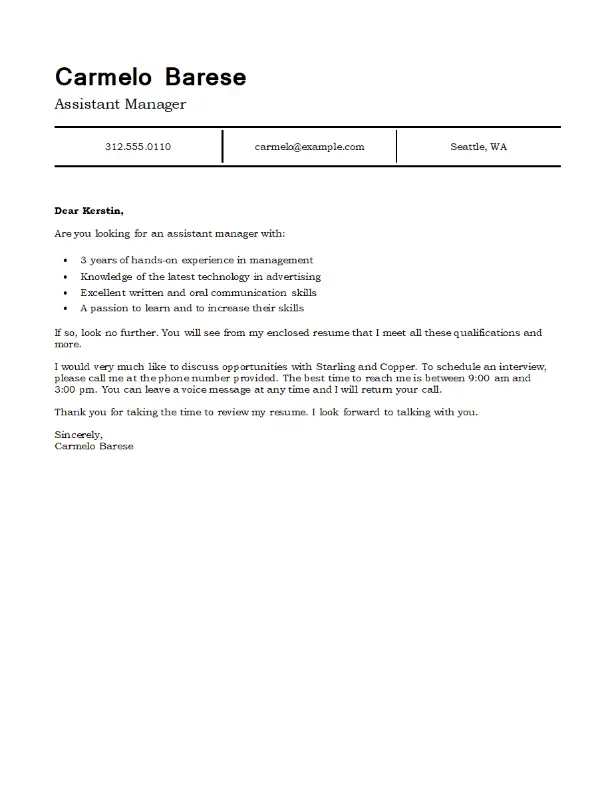

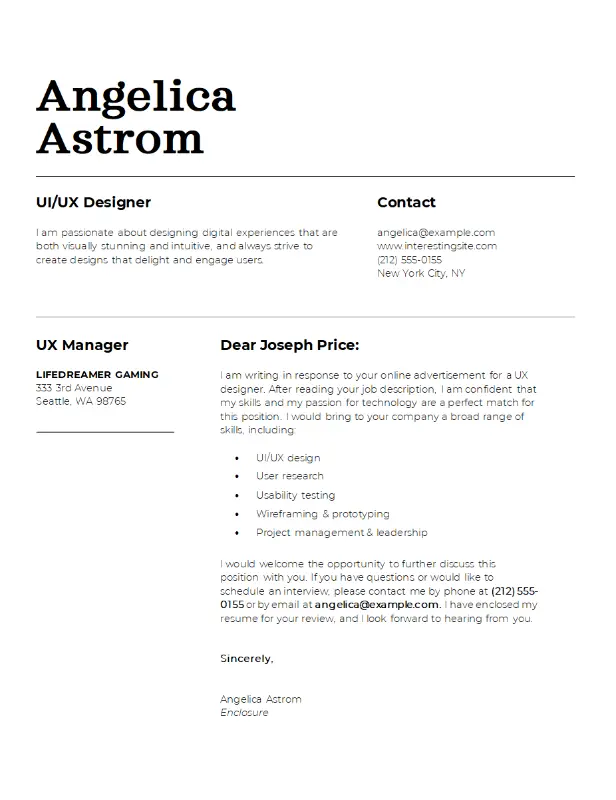

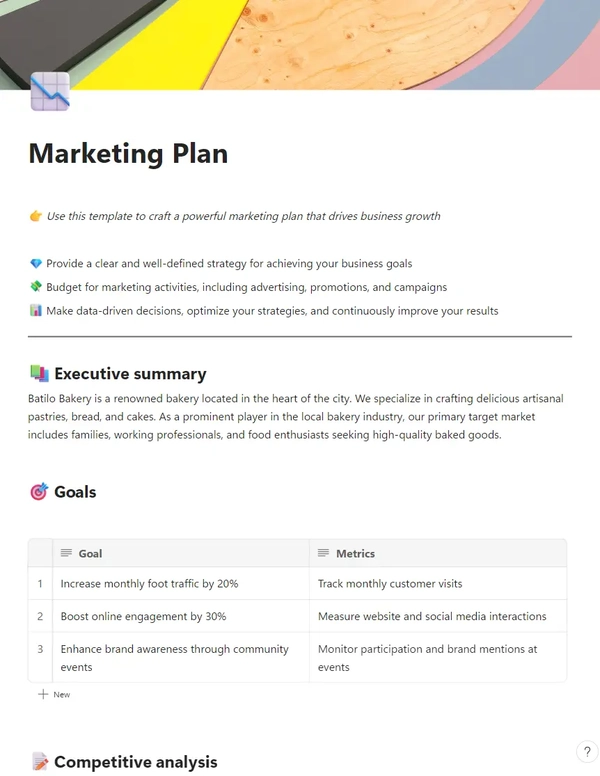

1. Start with the perfect template

Search for anything—style, topic, image, or color—or look around the catalog for inspiration. You'll find professionally designed templates for whatever you need to create.