MICROSOFT 365 FOR HOME

Achieve the extraordinary

Unlock new capabilities, build your skills, and uncover worlds of possibility with Copilot1 in Microsoft 365.

How it works

Your routine just got an upgrade

- Reimagine what’s possible with AI-powered features1 in Microsoft 365. Edit photos and videos like a pro, turn simple ideas into stunning designs, and overcome writer’s block with confidence and ease.

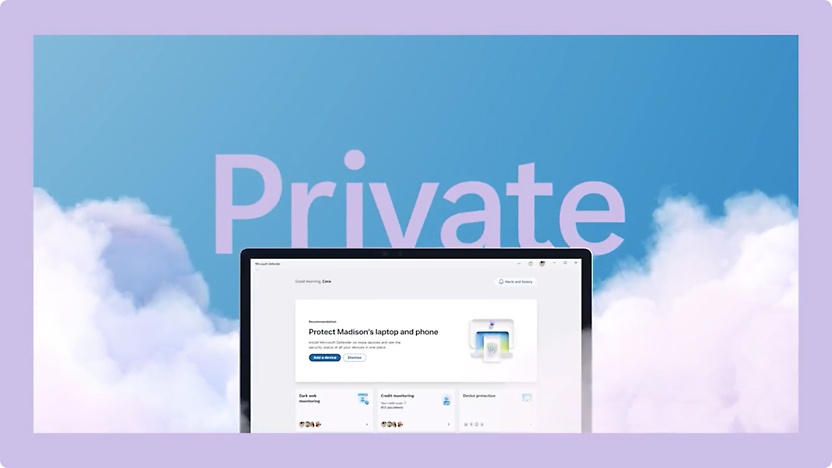

- Safeguard your photos, documents, phones, tablets, and computers with security tools and features designed to help keep your digital life secure.

- Elevate your expectations with AI-powered features1 in Microsoft 365. Get started seamlessly, focus on tasks, and stay on track with apps and cloud storage across your devices.

Featured news

Discover what’s happening with Microsoft 365

Copilot

Microsoft 365 Personal and Family now includes AI

The Microsoft 365 you know and love is better than ever before, with new AI-powered features.1

Microsoft's 50th Anniversary

Change needs makers

Join us in celebrating the bold, curious, exhilarating, groundbreaking, unpredictable and unforgettable things you’ve made over the past 50 years.

Copilot

Copilot

Copilot, your AI companion, is ready to support you whenever and wherever you need it.

Copilot

Get priority access

Enjoy priority access during peak times, get higher usage limits, and use Copilot in your favorite apps, like Word, Excel, PowerPoint, and Outlook.

What’s included

Redefine what’s possible with Microsoft 365

Explore Microsoft 365

Innovate with Microsoft 365

Discover what’s possible and turn ideas into reality anytime, anywhere.

Plans

Find the plan that’s right for you

Subscription continues to be charged at the regular price and selected term, unless canceled in Microsoft account.

Customers stories

See how customers accomplish more with Microsoft 365

Get started

Choose your plan

Create, share, and collaborate with your favorite apps—all in one place.

- App availability varies by device/language. Features vary by platform. Minimum age limits may apply to use of AI features. Details.

- [1]Microsoft 365 Personal or Family subscription required; AI features only available to subscription owner and cannot be shared; usage limits apply. Learn more.

- [2]AI usage limits apply; AI features only available to subscription owner and cannot be shared. Learn more.

- [3]Copilot in Excel requires AutoSave to be enabled, meaning the file must be saved to OneDrive; it doesn't function with unsaved files.

- [4]Copilot features in Outlook apply to accounts with @outlook.com, @hotmail.com, @live.com, or @msn.com email addresses and are available in Outlook.com, Outlook built into Windows, Outlook on Mac, and iOS and Android apps.

- [5]Identity theft monitoring is only available in the United States and US territories.

Follow Microsoft 365