Welcome to Microsoft Support

Please sign in so we may serve you better Sign in

Hello, , welcome to Microsoft Support

Trending topics

Microsoft account & storage

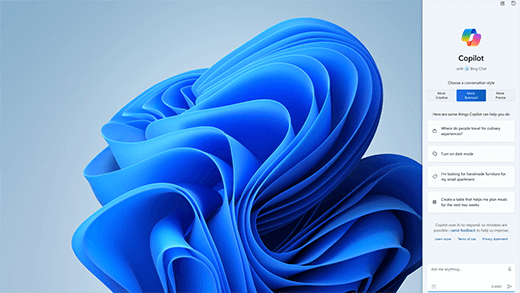

Meet Microsoft Copilot

Achieve anything you can imagine with your AI companion in the apps you already use every day.

Explore

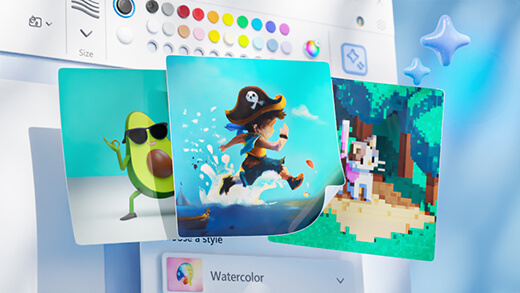

Generate art with Paint Cocreator

Create amazing artwork with just a few words. Microsoft Paint Cocreator will help you unleash your creativity and make your own artworks with the help of AI.

Achieve more with AI in Windows

Windows is the first PC platform to provide centralized AI assistance. Learn how to achieve and create more with Copilot in Windows.

Office is now Microsoft 365

The home for your favorite tools and content. Now with new ways to help you find, create, and share your content, all in one place.

Microsoft 365 Training Center

Get productive quickly with these Microsoft 365 videos, tutorials, and resources.

Microsoft 365 small business success stories

If you're a small business owner

Find the information you need to build, run, and grow your small business with Microsoft 365.

More support options

Contact Support

Enterprise support

Privacy & Security

More support

Get more with Copilot Pro

Supercharge your creativity and productivity with a premium Copilot experience. Download the Copilot app for a 1-month free trial of Copilot Pro.